Understanding Car Insurance Cost

Car insurance premiums can vary greatly depending on a number of factors. Understanding these factors and how they affect your premiums can help you make informed decisions when choosing an insurance policy.

Factors that affect car insurance cost

There are several factors that can impact your car insurance premium, including:

– Driving history: Your past driving behavior is often taken into account when calculating your premium. Drivers with accidents or traffic violations on their record will usually face higher premiums.

– Driving habits: How often and how far you drive can also impact your premium. Drivers who spend more time on the road are generally considered to be at a higher risk of accidents.

– Location: Your geographical location can play a role in your car insurance cost. Areas with higher crime rates or higher levels of traffic can result in higher premiums.

– Age and gender: Younger drivers and male drivers typically face higher insurance premiums due to statistics showing they are more likely to be in accidents.

– Credit score: Insurance companies may also consider your credit score when determining your premium, as there is a correlation between credit history and the likelihood of filing a claim.

– Marital status: Being married can sometimes result in lower insurance premiums, as married individuals tend to be seen as more responsible drivers.

How car insurance companies calculate premiums

Each insurance company has its own formula for calculating car insurance premiums. Some of the factors that a company might take into account include:

– Risk assessment: Insurance companies will use data and statistics to evaluate the likelihood of a policyholder filing a claim. This will include factors like driving history, age, gender, and location.

– Coverage options: The level of coverage you choose will impact your premium. For example, policies with high deductibles typically have lower premiums.

– Vehicle make and model: Certain types of vehicles may be seen as higher-risk, and insurance companies may charge higher premiums for coverage on these vehicles.

– Discounts: Many insurance companies offer discounts for things like safe driving habits, having multiple policies, or being a good student.

It’s important to shop around and compare rates from different insurance companies. Even if you have a good driving record, you may be able to find a better deal by switching to a different insurer. You can also take steps to lower your premiums by driving safely, maintaining good credit, and taking advantage of available discounts.

National Average Car Insurance Cost

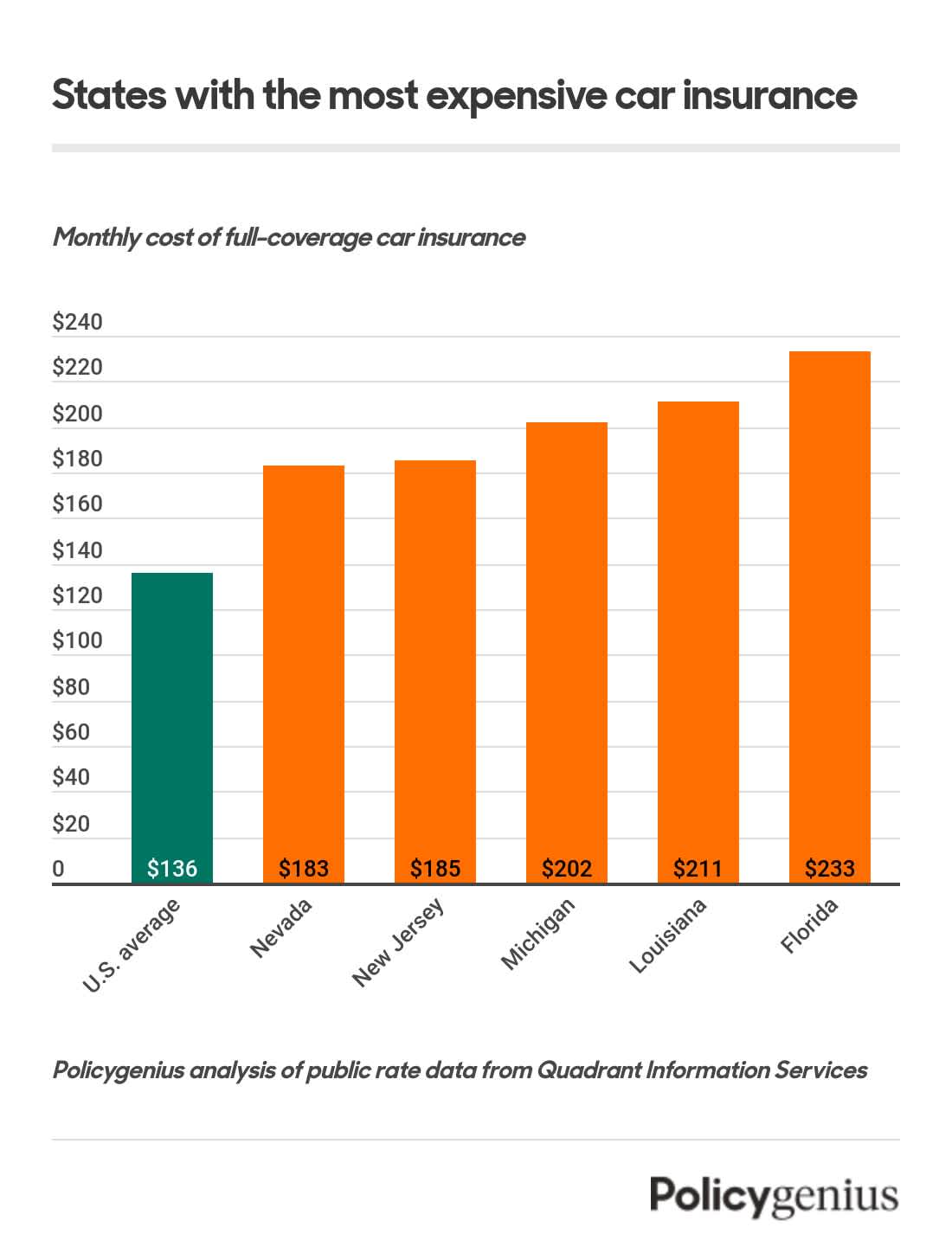

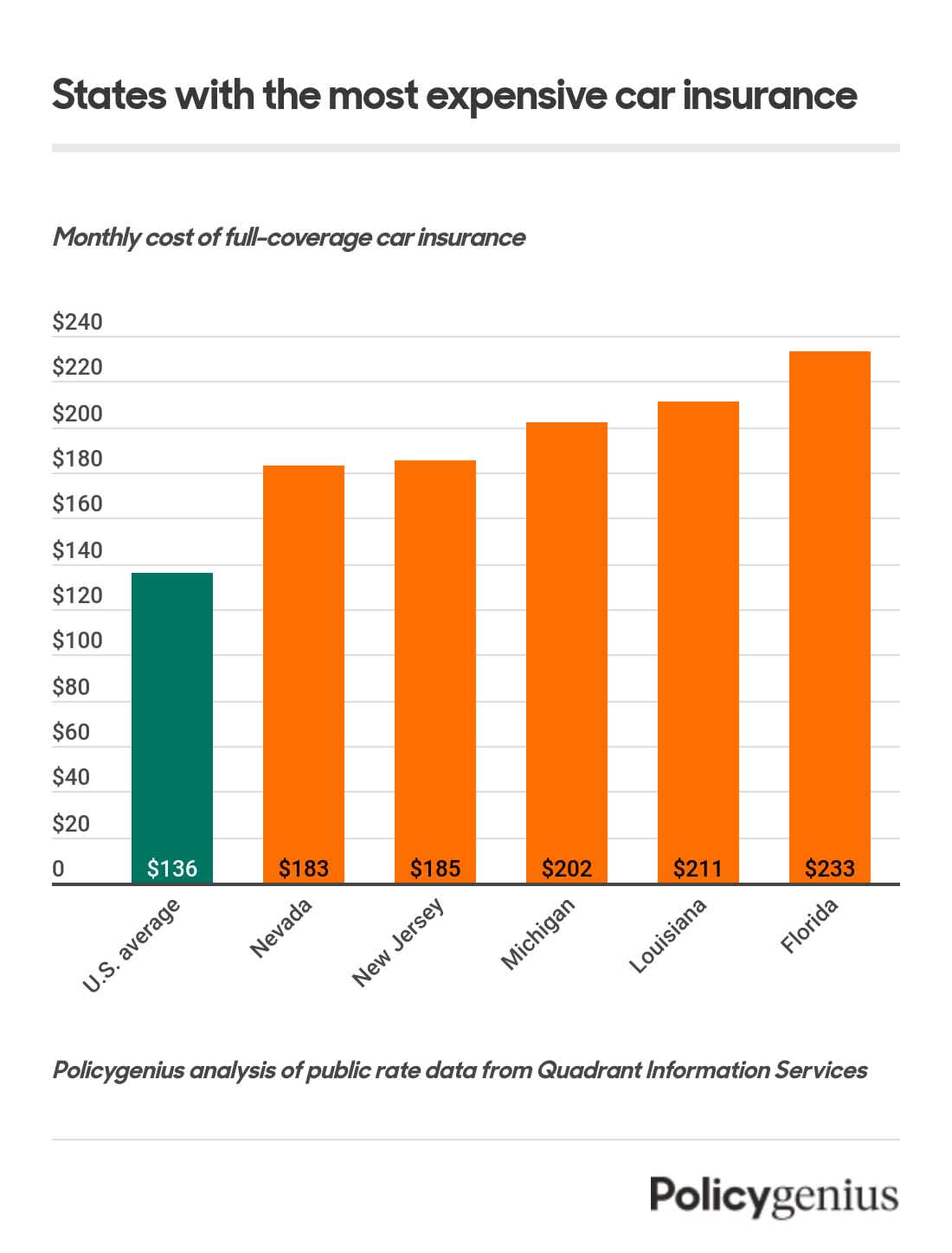

When it comes to car insurance, Americans pay an average of $2008 per year, or $167 per month, for full-coverage car insurance, according to cost data from Quadrant Information Services. Meanwhile, the average cost for minimum-liability coverage is $627 per year or $52 per month.

It’s worth pointing out that car insurance rates can vary widely by location due to each state’s minimum insurance requirements and laws, local risk factors, and other factors. To get a better sense of how full-coverage rates compare nationwide, we’ve included a map below.

Full coverage versus minimum coverage

When it comes to choosing between full-coverage and minimum coverage car insurance, it’s important to understand the differences between the two.

Full-coverage car insurance includes liability, collision, comprehensive coverage, and any additional coverages you may need. Liability coverage, required in every state, helps pay for damage you cause to other people and their property in an accident. Collision coverage pays for damage to your car if you get into an accident, while comprehensive coverage pays for damage caused by other things, such as natural disasters or theft.

Minimum-liability car insurance, on the other hand, only covers the damage you cause to others’ cars and property in an accident. While it may be cheaper, it could cost you more in the long run if you get into a serious accident and don’t have enough coverage.

National average car insurance cost for different demographics

Car insurance rates can also vary by demographic factors, such as age, gender, and marital status. For example, young drivers typically pay more than older drivers, and men typically pay more than women.

According to the Insurance Information Institute, the national average car insurance rates for different demographic groups are:

– Teen drivers: $3,253 per year

– Single drivers: $1,360 per year

– Married drivers: $1,266 per year

– Divorced drivers: $1,371 per year

– Widowed drivers: $1,325 per year

– Male drivers: $1,550 per year

– Female drivers: $1,445 per year

It’s important to remember that these are just national averages and that each individual’s rates may vary depending on other factors, such as driving record and credit score.

Overall, while car insurance rates can be affected by a variety of factors, it’s important to make sure you have adequate coverage for your individual needs. Shopping around for the best rates and coverage options can help ensure you’re getting the most value for your money.

How to Calculate Your Car Insurance Payment

Calculating car insurance costs can seem overwhelming, but it’s important to understand how much insurance coverage you need for your individual situation. Here are some factors to consider when calculating your monthly payment:

Factors to consider when calculating your monthly payment

1. Type of coverage: Your car insurance coverage will impact your monthly payment. Full coverage typically includes liability, collision, and comprehensive coverage, while minimum liability covers only damage you cause to others.

2. Driving record: Insurance companies will look at your driving record to determine your rates. Drivers with a clean record may be eligible for lower rates, while drivers with a history of accidents or violations may pay more.

3. Vehicle type: Your vehicle type can impact your rates. More expensive cars or with a higher risk of theft may result in higher insurance rates.

4. Age and gender: Younger and male drivers typically pay higher insurance rates than older or female drivers.

5. Location: Your location can impact rates due to each state’s minimum insurance requirements and local risk factors.

Tools and resources for estimating your car insurance cost

To get an estimate of your monthly car insurance payment, you can use online calculators and tools. NerdWallet’s car insurance estimator can estimate how much full coverage may cost in your area. Other resources include:

1. Insurance company websites: Many insurance companies have online quote tools that can estimate your monthly payment.

2. Independent insurance agents: If you prefer a more personalized approach, an independent insurance agent can help you determine the coverage you need and estimate your monthly payment.

3. State insurance departments: Each state has an insurance department that can provide resources and information on car insurance coverage and rates.

By considering these factors and utilizing available resources, you can better understand how much your car insurance payment may be. It’s important to shop around and compare rates from multiple insurers to ensure you’re getting the most value for your money.

Car Insurance Cost by Company

Car insurance rates vary by insurance company, and each company uses different factors to determine those rates. A driver’s age, driving history, ZIP code, and type of car are some of the main factors that insurance companies use to calculate car insurance rates.

Here we’ll take a look at the cost of car insurance from some of the top national carriers in the United States based on average annual premiums for full coverage.

Comparison of car insurance costs from top national carriers

According to NerdWallet, some of the top national carriers charge the following average annual premiums for full-coverage insurance:

– State Farm: $1,457

– Geico: $1,405

– Progressive: $1,766

– Allstate: $1,896

It’s important to note that these are average rates and just an estimate. Your actual rate will depend on factors like your location, driving record, and type of car.

Factors that affect car insurance cost by company

Different insurance companies weigh each consideration differently when calculating car insurance rates. Here are some factors that can impact the cost of car insurance from company to company:

– Claims history: If a company has paid out a lot of claims in an area, they might charge more for insurance in that area.

– Coverage limits: Higher limits of coverage typically mean higher premiums.

– Discount offerings: Some companies might offer more discounts for safe drivers or bundled policies.

– Company size: Larger companies may have more resources and experience to help them offer lower rates.

No matter what company you choose, remember that car insurance rates can vary significantly depending on a number of factors. It’s always a good idea to shop around and compare rates from multiple companies to ensure you’re getting the best deal on coverage that meets your specific needs.

Cheapest Car Insurance Providers

When it comes to car insurance, drivers are always looking for the best deal. Here, we’ll take a look at some of the cheapest car insurance providers for drivers in Illinois, as well as some factors to consider when choosing a provider.

Top companies offering the cheapest car insurance rates for full coverage and minimum coverage

According to recent estimates, some of the cheapest car insurance providers in Illinois include:

Full Coverage:

| Insurance Company | Average Monthly Cost | Estimated Annual Cost |

|---|---|---|

| Geico | $115 | $1375 |

| Erie Insurance | $127 | $1527 |

| Auto-Owners Insurance | $128 | $1535 |

| Progressive | $173 | $2072 |

Minimum Coverage:

For a 35-year-old driver, the average estimate for an Illinois state minimum policy is around $441 per year or $137 per month.

Again, it’s important to keep in mind that these are just estimates and rates can vary drastically based on individual factors.

Factors to consider when choosing a cheaper car insurance provider

Price isn’t the only factor to consider when choosing a car insurance provider. Here are some other important considerations to keep in mind:

– Coverage options: Make sure you understand the different types of coverage an insurance provider offers and choose one that has the coverage levels you need.

– Customer service: It’s important to choose a company with a good customer service reputation and responds promptly to claims.

– Financial stability: You want to choose an insurance provider with a strong financial rating so you can be sure they’ll be able to pay out claims if necessary.

– Discounts: Look into discounts that a provider offers, such as safe driver discounts, multi-car discounts, or student discounts.

When comparing car insurance providers, keep these factors in mind so you can make an informed decision and choose the provider that’s right for you.

Expensive Car Insurance Providers

While car insurance rates can vary greatly depending on a number of factors, some national providers tend to offer more expensive rates for both full coverage and minimum coverage options. Here, we’ll take a look at some of the top expensive car insurance providers based on average annual premiums.

Top companies offering some of the highest car insurance rates for full coverage and minimum coverage

Based on data from NerdWallet, some of the top companies that tend to offer more expensive car insurance rates for both full coverage and minimum coverage include:

– Farmers: Farmers is known for its extensive coverage options, but that coverage comes at a price. The average annual premium for full coverage with Farmers is about $2,225, one of the industry’s highest rates. For minimum coverage, the average premium is around $690.

– Nationwide: Nationwide is another provider that tends to charge high rates for car insurance. The average annual premium for full coverage with Nationwide is about $1,864, and minimum coverage averages around $559 per year.

– Liberty Mutual: Liberty Mutual is known for its customizable insurance offerings, but those offerings can also make it one of the more expensive providers. The average annual premium for full coverage is about $2,114, while minimum coverage averages around $724 annually.

Again, it’s important to remember that these are just average rates and your personal circumstances will play a major role in the final cost of your car insurance.

Factors to consider when dealing with expensive car insurance providers

If you find that you’re dealing with one of the more expensive car insurance providers, there are a few factors you can consider to lower your rates potentially:

– Adjust coverage amounts: If you’re currently paying for more coverage than you need, adjusting your coverage limits could help lower your premium.

– Improve driving habits: Safe drivers are less risky for insurance companies to cover, so consider ways to improve your driving habits to lower your rates potentially.

– Shop around: Even if you’re currently with an expensive car insurance provider, comparing rates from multiple companies is always a good idea to see if you can save money.

In conclusion, while certain national car insurance providers tend to offer higher rates than others, it’s important to remember that each individual’s circumstances will play a major role in determining their specific premium. By understanding the factors affecting car insurance rates and taking steps to adjust coverage and improve driving habits, drivers can save significant amounts on their car insurance over time.

Tips for Lowering Car Insurance Cost

When it comes to car insurance, finding affordable coverage can be a challenge for many drivers. However, there are several steps that drivers can take to help lower the cost of their car insurance premiums. Here are some tips for lowering car insurance costs:

Improving your driving record, credit score, and other ways to lower your insurance premium

– Maintain a good driving record: By avoiding accidents and traffic violations, drivers can earn a safe driver discount or a lower risk auto insurance rating, which can help to reduce their car insurance premiums.

– Improve your credit score: Car insurance companies often use credit scores as a factor when determining rates, so maintaining a good credit score can lead to lower insurance premiums.

– Consider higher deductibles: Raising your deductible, or the amount you pay out of pocket for car repairs before insurance kicks in, can help to lower your monthly or annual premium.

– Drop unnecessary coverage: If you’re driving an older car or paid off vehicle, you may want to consider dropping optional coverage such as collision or comprehensive insurance, which can help to lower your insurance premium.

Steps to take when you can’t afford your insurance payment

– Contact your insurance provider: If you are struggling to make payments on your car insurance, it’s important to contact your provider right away. They may be able to work with you to set up a payment plan or suggest options to lower your insurance premium.

– Shop around: If you can’t afford your current car insurance premium, it may be time to shop around for better rates. Comparing quotes from several insurance companies can help you find affordable coverage that fits your budget.

– Consider alternative coverage options: In some cases, drivers may be able to find more affordable coverage through alternative options such as usage-based insurance, which calculates rates based on driving habits, or non-standard auto insurance providers.

While there are several steps that drivers can take to help lower the cost of their car insurance, it’s important to keep in mind that car insurance rates can vary significantly based on a number of different factors. However, drivers can make sure they are getting the most affordable coverage possible by taking steps to improve their driving record and credit score, adjusting coverage amounts, and shopping around for better rates.

Frequently Asked Questions about Car Insurance Cost

When it comes to car insurance cost, there are many questions that drivers may have. Here, we’ll answer some of the most common questions to help you better understand what factors can impact your premium.

Answers to common car insurance cost-related questions:

What factors impact car insurance costs? Car insurance costs can be impacted by a number of factors, including your age, gender, driving record, credit score, and the type of car you drive. Your coverage level can also play a major role in determining your premium.

Why do car insurance rates vary by state? The state where you live can impact car insurance rates due to factors such as claim reporting frequency, the cost of labor and parts, and the number of uninsured drivers on the road.

Can I get car insurance if I have a poor driving record? Yes, you can typically still get car insurance if you have a poor driving record. However, your premium may be higher than someone with a clean driving record.

How can I lower my car insurance rates? There are several ways to potentially lower your car insurance rates, including adjusting your coverage levels, improving your driving habits, and shopping around for better rates.

Related car insurance topics to explore:

– Understanding the different types of car insurance coverage

– Tips for getting the best car insurance rates

– Common car insurance discounts and how to qualify for them

Remember, while car insurance cost can vary greatly based on a number of factors, it’s important to shop around and compare rates from multiple companies to find the best coverage at the most affordable price for your individual needs.

Ways to ensure you’re not overpaying for car insurance

To ensure you’re not overpaying for car insurance, follow these tips:

– Compare rates from multiple insurance companies to find the most affordable coverage

– Consider adjusting your coverage levels to find a balance between protection and affordability

– Take advantage of discounts that you may be eligible for

– Improve your driving habits to avoid accidents and tickets that can increase your premium

Key takeaways from the article:

– Car insurance cost is influenced by several factors, including age, gender, driving record, credit score, and the type of car you drive

– Rates can vary greatly from state to state due to different factors

– You can still get car insurance with a poor driving record but may pay a higher premium

– To lower rates, consider adjusting coverage levels, improving driving habits, and shopping around for better rates.