Closing costs are the fees associated with buying a home that you must pay on closing day. They include all the expenses related to applying for the loan and finalizing a real estate sale. These costs can be paid by either the buyer or the seller. In most cases, the seller pays a portion of the closing costs, while the buyer pays the remaining balance.

Definition of Closing Costs and Why They Exist

Closing costs exist to cover all the expenses related to a real estate transaction. These costs are paid to various parties involved in the sale of a property, including real estate agents, lenders, attorneys, and title companies. The fees cover everything from appraisals and inspections to administrative costs and legal fees.

The purpose of closing costs is to ensure that the real estate transaction is legally binding and that all parties involved are protected. For instance, title companies conduct title searches and issue insurance policies to protect the buyer and lender in case any issues arise in the future. Appraisal fees ensure that the property is worth the price being paid, and attorney fees ensure that all the necessary legal documents are in order.

Types of Closing Costs

There are several types of closing costs involved in a real estate transaction. Some of the most common ones include:

– Appraisal fees: These fees cover the cost of hiring an appraiser to determine the value of the property.

– Title fees: These fees cover the cost of a title search and title insurance to protect the buyer and lender in case any issues arise with the title in the future.

– Origination fees: These fees cover the cost of processing the loan application and underwriting the loan.

– Recording fees: These fees cover the cost of recording the deed and mortgage with the local government.

– Inspection fees: These fees cover the cost of hiring a home inspector to identify any potential issues with the property.

– Attorney fees: These fees cover the cost of hiring an attorney to review all the legal documents involved in the real estate transaction.

In general, closing costs typically range from 2 to 5 percent of the total loan amount. However, the specific costs associated with a given transaction can vary widely, depending on the location of the property, the lender involved, and other factors. As a buyer, it’s important to understand the different types of closing costs and negotiate with the seller to reduce the overall cost of the transaction.Lender Requirements

When it comes to closing costs, lenders require certain fees to be paid in order to cover the costs of processing the loan. These fees can vary based on the type of loan, the lender, and the location of the property. It is important to understand these requirements and the breakdown of fees in order to be financially prepared for homeownership. Here are some of the fees that may be required by lenders:

Origination Fees and Discount Points:

One of the fees that lenders often require is an origination fee, which covers the cost of processing the loan application. This fee can vary, but is typically around 1% of the loan amount. Additionally, some lenders may require discount points, which are essentially prepaid interest on the loan. These points can lower the interest rate on the loan, but they do come at a cost. Each point typically costs 1% of the loan amount.

Appraisal and Credit Report Fees:

Another requirement for closing costs is an appraisal fee. This covers the cost of having a professional appraiser determine the value of the property. This fee can vary depending on the location of the property and the scope of the appraisal, but typically ranges from $300 to $600. Additionally, lenders may require a credit report fee to cover the cost of pulling your credit report. This fee is usually around $30 to $50.

Other Fees:

In addition to the fees mentioned above, there may be other fees required by lenders. These can include title insurance, recording fees, and underwriting fees. Title insurance protects the lender and the borrower in case of any issues with the title of the property. Recording fees cover the cost of recording the property transfer with the local government. Underwriting fees cover the cost of the lender reviewing the loan application and making a decision on whether or not to approve the loan.

Overall, it is important to understand the lender requirements for closing costs in order to budget appropriately for homeownership. By knowing what fees are required and approximately how much they will cost, borrowers can avoid surprises and make informed decisions about their financial situation.Title Insurance and Escrow Fees

When closing on a home, there are various fees and expenses involved beyond the down payment. Lenders may require certain fees to be paid in order to cover the costs of processing the loan. These fees can include origination fees, discount points, appraisal and credit report fees, and other fees such as title insurance and escrow fees.

Title Search and Title Insurance Fees

Title insurance protects the lender and borrower in case of any issues with the title of the property, such as liens, judgments, or unpaid taxes. This fee is typically included in the closing costs and is usually around 1% of the purchase price of the home or less than 10% of the total closing costs. Additionally, a title search fee may also be required, which covers the cost of researching the historical records of the property. This fee can vary but is typically around $100 to $300.

Escrow Fees and Homeowner’s Insurance

Escrow fees are another part of the closing costs and are typically between 1% and 2% of the sale price of the home. Escrow is a neutral third party that holds onto the funds during the closing process and manages the transfer of money and documents between the buyers, sellers, and lenders. Homeowner’s insurance is also required by lenders and covers the cost of any damages to the property due to events such as fire, theft, or natural disasters. The cost of homeowner’s insurance can vary depending on the location of the property, the value of the home, and the level of coverage.

In conclusion, understanding the various fees and expenses involved in closing on a home can help buyers prepare financially for the process. Lenders may require specific fees to be paid, such as origination fees, discount points, appraisal, and credit report fees, as well as other fees such as title insurance and escrow fees. As always, it is important for homebuyers to carefully review and understand all of the costs involved in purchasing a home.

Government Requirements

In addition to lender requirements, there are also government requirements for closing costs. These fees can vary by location and are typically designed to cover things like property taxes and transfer taxes. Understanding these requirements is an important part of preparing for homeownership.

Recording Fees and Transfer Taxes

One of the government requirements for closing costs is recording fees. These fees cover the cost of recording the transfer of property ownership with the local government. The amount of the fee varies based on the location of the property, but is typically between $25 and $250. Additionally, transfer taxes may be required. These taxes are imposed by state or local governments and are typically calculated as a percentage of the sale price or appraised value of the property.

Property Taxes and State Fees

Another government requirement for closing costs is property taxes. Depending on the location of the property, buyers may be required to pay up to a year’s worth of property taxes at closing. These taxes are typically based on the appraised value of the property, and can be estimated using public records and the appraisal value.

In addition to property taxes, buyers may also be required to pay state fees. These can include things like mortgage taxes, deed transfer taxes, and recording fees. The amount of these fees varies based on the location of the property and the specific requirements of the state.

It is important for homebuyers to be aware of these government requirements and to budget accordingly. By understanding these costs and incorporating them into their budget, buyers can avoid surprises and ensure a smooth and successful home purchase. It is important to work closely with your lender and real estate agent to understand all of the potential closing costs associated with your home purchase. By doing so, you can make informed decisions and be prepared for the financial obligations of homeownership.

Other Costs

In addition to the government and lender requirements for closing costs, there are also other costs that homebuyers may need to consider. These costs can vary based on the location of the property, the complexity of the transaction, and the specific needs of the buyer.

Home Inspection and Survey Fees

One of the most important steps in the homebuying process is the home inspection. This is a thorough examination of the property by a professional inspector, designed to identify any potential issues or defects that could impact the value or safety of the home. Depending on the location and complexity of the property, home inspection fees can range from a few hundred to over a thousand dollars.

Another common expense is the survey fee. This is the cost of having a professional surveyor evaluate the property boundaries and ensure that there are no encroachments or other complications that could impact the value or ownership of the property. This fee can also vary based on the location and complexity of the property, but is typically in the range of a few hundred dollars.

Attorney and Notary Fees

Depending on the location and complexity of the transaction, homebuyers may also need to pay for attorney or notary services. These professionals can assist with the preparation and review of legal documents, ensure that the transaction is legally compliant, and provide guidance and support throughout the process. These fees can also vary, but are typically in the range of a few hundred to several thousand dollars.

It is important for homebuyers to carefully consider all of the potential costs associated with their purchase, and to work closely with their lender and real estate agent to ensure that they are fully prepared for the financial obligations of homeownership. By understanding all of the potential costs and incorporating them into their budget, buyers can avoid surprises and ensure a successful and stress-free home purchase.

How Much Are Closing Costs?

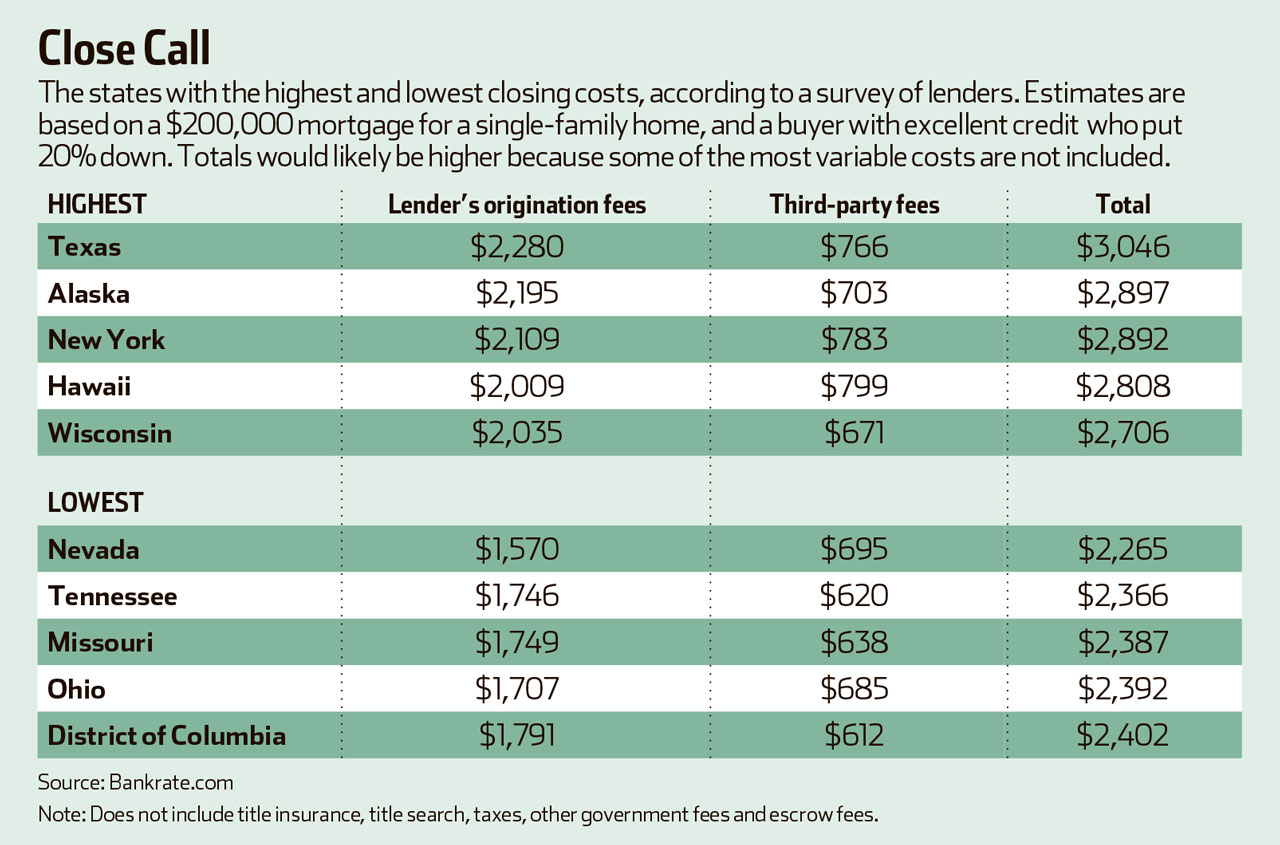

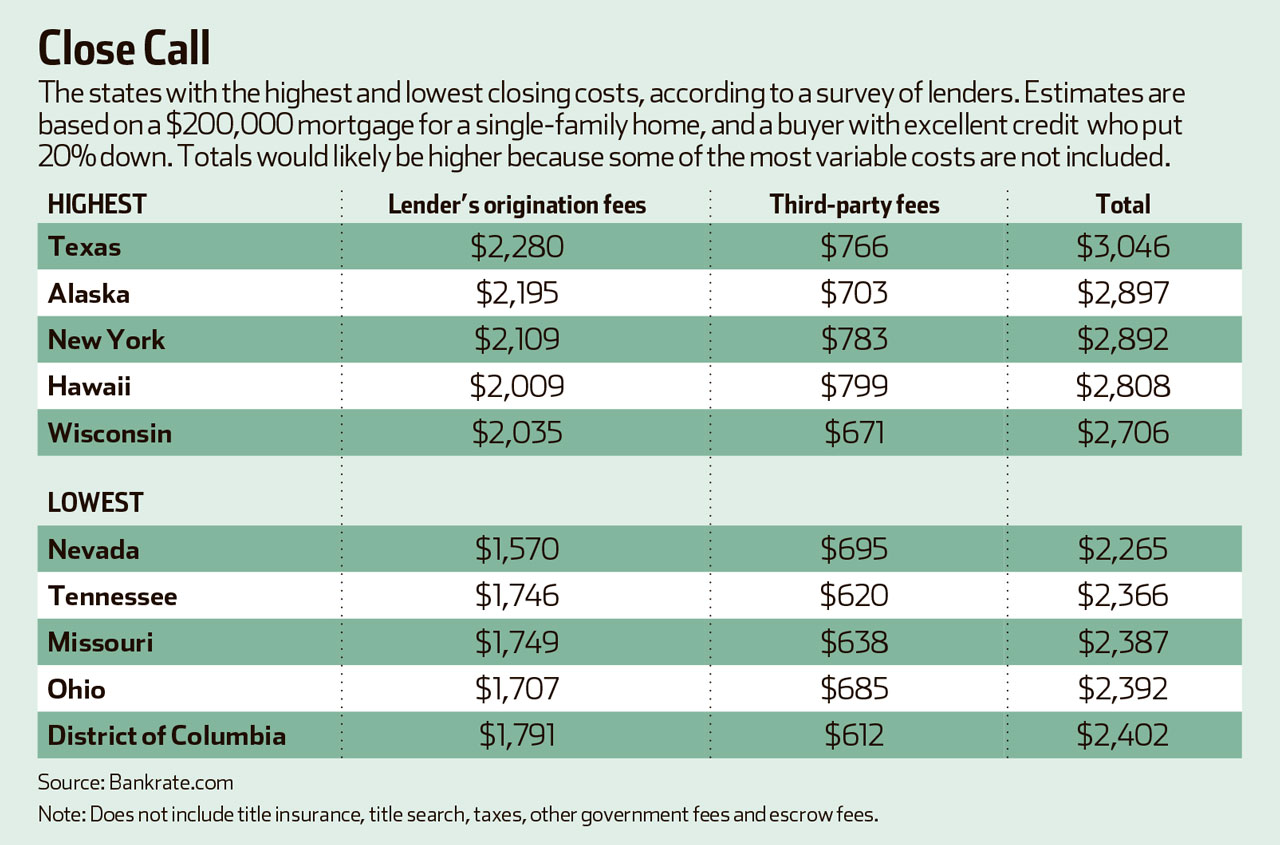

Closing costs are a necessary part of the homebuying process and can vary depending on a range of factors. However, as a rule of thumb, closing costs will generally amount to 3% to 6% of the purchase price of the property. The average closing costs in Maryland, for instance, can range from 3% to 6% of the sales price.

Average Percentage of Closing Costs

The percentage of closing costs that buyers can expect to pay will vary from state to state and even from lender to lender. In addition to the 3% to 6% range, some reports estimate that closing costs can be as much as 8% of the purchase price of the home.

Factors That Affect Closing Costs

Several factors can influence the amount of closing costs that a buyer will be expected to pay. Some of the most common factors include:

– Location: The location of the property can play a major role in determining closing costs, as there are often government requirements that must be met. For example, some states require buyers to pay transfer taxes or mortgage taxes, while others may have higher-than-average recording fees.

– Loan type: The type of loan that a buyer takes out can also impact closing costs, as some lenders may require additional fees for certain types of mortgages.

– Property type: Different types of properties, such as co-ops, condos, or townhouses can also impact the amount of closing costs that a buyer will pay.

– Negotiations: Buyers may be able to negotiate with the seller to reduce some of the closing costs, particularly if they are willing to pay a higher purchase price.

It’s essential for homebuyers to work closely with their lender and real estate agent to understand all of the potential closing costs associated with their home purchase. While an estimate of closing costs is usually provided early in the process, it’s important to understand that these costs are subject to change. At least 3 business days before the closing meeting, the buyer will receive a Closing Disclosure document that lists all the final closing costs they need to pay.

In addition to lender requirements, there are also government requirements for closing costs that buyers need to be aware of and budget for. Recording fees and transfer taxes are two common government requirements that can vary in amount by location. Additionally, buyers may be required to pay up to a year’s worth of property taxes at closing, which are usually based on the appraised value of the property.

By understanding closing costs and all the factors that influence them, buyers can make informed decisions and be prepared for the financial obligations of homeownership.

How to Estimate Closing Costs

When buying a home, one of the most important things to consider is the cost of closing. Closing costs are the fees associated with the final stages of the homebuying process and can include a variety of expenses that need to be paid. As a rule of thumb, closing costs are generally around 3% to 6% of the purchase price of the home, but this can vary depending on a range of factors.

Closing Costs Calculator

One helpful tool for estimating closing costs is a closing costs calculator. This calculator allows buyers to estimate their total closing expenses, including prepaid items, third-party fees, and escrow. Some lenders, such as Bank of America, offer online closing cost calculators that can help buyers plan and budget for their expenses.

GFE and LE Estimates

Another way to calculate closing costs is through the Good Faith Estimate (GFE) and the Loan Estimate (LE). Lenders are required to provide a GFE to prospective borrowers within three business days of receiving their loan application. This document provides an estimate of the closing costs associated with the loan, including the interest rate, loan fees, and other charges.

The LE, on the other hand, is provided by the lender after receiving the borrower’s application and is required by law. The LE provides an itemized list of the closing costs associated with the loan and must be provided to the borrower at least three business days before closing. It is important for buyers to carefully review both the GFE and the LE to understand the estimated closing costs associated with the loan.

Factors That Affect Closing Costs

Several factors can impact the amount of closing costs associated with a home purchase. One of the biggest factors is the location of the property. Different states and localities have varying requirements for closing costs, such as transfer taxes or recording fees, which can significantly impact the amount that a buyer will need to pay.

The type of loan can also impact closing costs, as certain types of mortgages may require additional fees. Additionally, the type of property being purchased can impact the closing costs, as different types of properties, such as townhouses or condos, may have unique fees associated with them.

Finally, buyers may be able to negotiate with the seller to reduce some of the closing costs, particularly if they are willing to pay a higher purchase price. By understanding all of the potential closing costs associated with a home purchase, buyers can be prepared for the financial obligations of homeownership.

In conclusion, estimating closing costs is an important part of the homebuying process. Buyers can use tools like closing cost calculators and GFEs/LEs to estimate their expenses, but it’s also important to be aware of the factors that can impact the amount of closing costs, including location, loan type, property type, and negotiations. By working closely with their lender and real estate agent, buyers can prepare for closing costs and make informed decisions when purchasing a home.

Negotiating Closing Costs

When buying a home, closing costs can add up quickly. However, there are ways to negotiate these costs to save money. By negotiating with service providers like title companies, buyers may be able to reduce their fees. Additionally, understanding which fees are negotiable can help buyers decide which costs to push back on.

How to Negotiate Your Closing Costs

Negotiating closing costs can be complex, but buyers can take a few steps to increase their chances of saving money. One of the most effective methods is to ask the service provider to reduce their fees simply. In some cases, they may be willing to offer a discount or even waive the fee entirely.

Another approach is to shop around and compare pricing from different service providers. Buyers may find that one provider offers lower fees than another, giving them leverage to negotiate. Lenders, real estate agents, and other professionals involved in the transaction may also be a good resource for finding lower-cost service providers.

It’s important to note that not all fees are negotiable, and the lender or government regulations may require some. Buyers should work closely with their lender and real estate agent to understand which fees are fixed and which may be negotiated.

Tips for Saving Money on Closing Costs

In addition to negotiating fees, there are other ways buyers can save money on closing costs. Some tips to consider include:

– Knowing the fees: Understanding the various closing costs and which party is responsible for them is key to negotiating lower costs.

– Shop around: Comparing pricing from different service providers can help buyers find the best deal on closing costs.

– Ask for discounts: Even if fees aren’t negotiable, asking for a discount can sometimes result in savings.

– Bundle services: Choosing to work with a service provider that offers multiple services (such as title and escrow) can often result in lower overall costs.

– Consider timing: Depending on the time of month or year, service providers may be more willing to negotiate on fees.

Closing costs can be a significant financial burden for homebuyers, but negotiating and exploring cost-saving options can make the process more manageable. By being proactive and asking questions, buyers can ensure that they are getting the best deal on their closing costs while still navigating the complexities of the homebuying process.

Wrap-Up of Key Takeaways About Closing Costs

Closing costs can add up quickly, but there are ways to negotiate and save money. Buyers should shop around, compare pricing from different service providers, and ask for discounts or bundled services. While not all fees may be negotiable, understanding which ones are and working with a lender and real estate agent can help buyers make informed decisions. It’s important to budget for and understand the significance of closing costs to complete the homebuying process successfully.